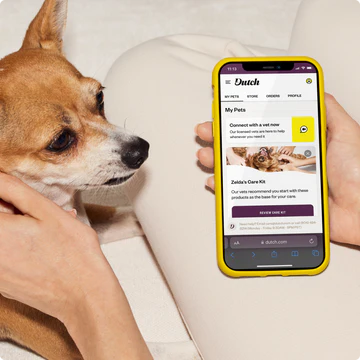

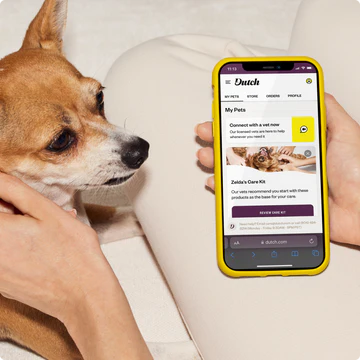

Better virtual vet care meets real emergency insurance

Help your pet feel better while lowering their stress and vet bills with pet insurance by Pets Best - $9 month for dogs, $6 month for cats

- Unlimited video calls with licensed vets

- Prescriptions shipped free to you

- $10,000/year emergency insurance

Focus on your pet’s health, not costs

Unlimited virtual care for everyday issues

$10,000/year for emergency vet trips

$10,000 for those scary moments

- Use it for one or multiple emergencies

- Get emergency care at any U.S. vet

- See a vet without any pre-approval

A real-world example of coverage

Coco’s emergency vet visit for swallowing hair ties:

Invoice amount

Plan covered

Insurance for everything from cuts to car accidents

Examples of what’s covered

- Injuries and wounds

- Poisoning

- Bites (animal, insect, snakes)

- Hit by car or moving vehicle

- Foreign body ingestion

Examples of what’s not covered

-

Pre-existing injuries

-

Cruciate ligament injuries

-

Any illnesses or diseases

See the full details about what’s covered and what’s not from our insurance partner, Pets Best.

What you get with our Annual + Insurance plan

- 100% licensed vets

- Customized treatment plans

- Unlimited Dutch vet calls

- Free shipping

- Virtual care for up to 5 pets

- $10,000/yr accident insurance

Frequently asked questions

What is pet insurance?

What is pet insurance?

Pet insurance reimburses you for eligible costs on your veterinary bills, depending on the type of insurance that you have and your policy details. Like most types of insurance, there’s typically a deductible, which is an amount you must pay yourself before you can start getting reimbursed. There are generally three types of pet insurance: illnesses + accident plans, wellness plans, and accident-only plans. The insurance in the Dutch Protector plan is accident-only coverage.

Pet insurance helps you afford the best course of treatment, protects against major financial setbacks, and can give you peace of mind as a pet parent. Having a pet insurance plan can help you to focus on getting the best care for your pet without worrying about the financial burden.

How does the Dutch insurance plan work?

How does the Dutch insurance plan work?

The insurance available through our Protector plan is an accident-only plan with coverage up to $10,000/year. This means the insurance covers in-person vet costs for your pet due to accidents (such as a car accident, eating something toxic, breaking a bone, or an animal bite), but not regular illnesses or preventive care. You can use this coverage for multiple accidents affecting the covered pet within a year of the policy starting until you reach the $10,000 limit.

When an accident happens, you can go to any vet in the U.S. — no need to talk to one of our vets or Pets Best (our insurance partner) first. You pay the vet, then submit your claim through the Pets Best app or website. They’ll process the claim, then reimburse you for eligible costs after you meet the $250 annual deductible and 10% coinsurance. Can’t pay the vet bill upfront? You can use the Vet Direct Pay option to have the vet get paid directly by Pets Best.

For full details on how the plan works and what’s covered, see the sample policy.

Who provides the insurance for Dutch?

Who provides the insurance for Dutch?

Dutch’s emergency insurance is provided through our partner Pets Best, one of the top pet insurance providers in the country.

How do I make a claim?

How do I make a claim?

When an accident happens, you can go to any vet in the U.S. — no need to talk to one of our vets or Pets Best (our insurance partner) first. You pay the vet, then submit your claim through the Pets Best app or website. You don’t need to submit any medical records unless they ask for them. They’ll process the claim, then reimburse you for eligible costs after you meet the $250 deductible and 10% coinsurance.

Can’t pay the vet bill upfront? If your vet is willing to extend credit, you can use the Vet Direct Pay option to have the vet get paid directly by Pets Best so you don’t have to worry about paying an expensive vet bill.

How and when does my insurance coverage become active?

How and when does my insurance coverage become active?

Your accident-only insurance coverage automatically becomes active on the first of the month after you sign up for the Protector plan.

Waiting periods, annual deductible, co-insurance, benefit limits, and exclusions may apply. For all terms visit http://www.petsbest.com/policy . Products, schedules, discounts, and rates may vary and are subject to change. Premiums are based on and may increase or decrease due to the age of your pet, the species or breed of your pet, and your home address.

Pet insurance coverage offered by Dutch Pet, Inc (NPN 20387499; CA license #6008289) and administered by Pets Best Insurance Services, LLC is underwritten by American Pet Insurance Company (NAIC #12190), a New York insurance company headquartered at 6100 4th Ave. S. Suite 200 Seattle, WA 98108, or Independence American Insurance Company (NAIC #26581), a Delaware insurance company located at 11333 N. Scottsdale Rd. Ste. 160 Scottsdale, AZ 85254, or MS Transverse Insurance Company (NAIC #21075), located at 15 Independence Blvd. Suite 430, Warren, NJ 07059. Pets Best Insurance Services, LLC (NPN #8889658, CA agency #0F37530) is a licensed insurance agency located at 11333 N. Scottsdale Rd. #160 Scottsdale, AZ 85254. Each insurer has sole financial responsibility for its own products. Please refer to your declarations page to determine the underwriter for your policy. Terms and conditions apply. See your policy for details.